Once in a very great while, there comes a year in the economy and the markets that may serve as a tutorial—a master class in the principles of successful long-term, goal-focused investing. Two thousand twenty was just such a year.

On December 31, 2019, the Standard & Poor’s 500-Stock index closed at 3,230.78. With reinvested dividends, the total return of the S&P 500 was about 18.40%. Non-US developed markets, as measured by the MSCI World ex USA Index, returned 7.59%. Emerging markets, as measured by the MSCI Emerging Markets Index, returned 18.31% for the year.

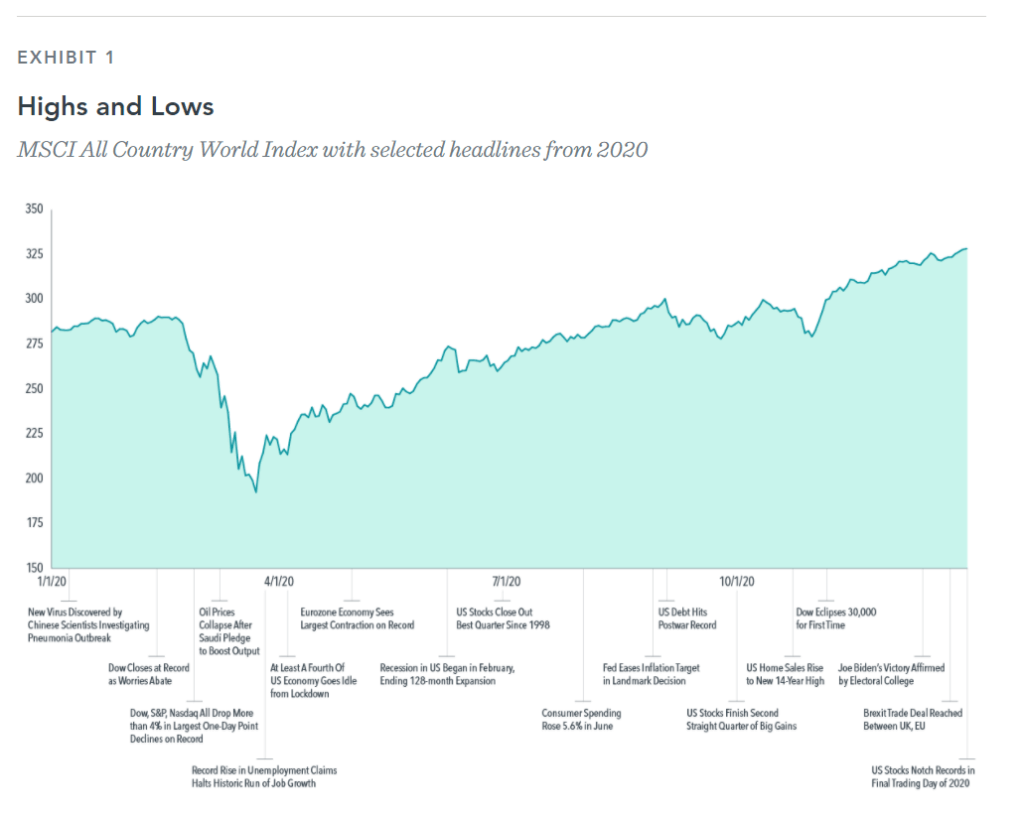

From these bare facts, you might conclude that the equity market had, in 2020, quite a good year. As indeed it did. What should be so phenomenally instructive to the long-term investor is how it got there.

Source: MSCI ACWI Index (net div.). MSCI data © MSCI 2021, all rights reserved.

From a new all-time high on February 19, the market reacted to the greatest public health crisis in a century by going down roughly a third in five weeks. The rapid decline was unprecedented. The Federal Reserve and Congress responded with massive intervention, the economy learned to work around the lockdowns—and the result was that the S&P 500 regained its February high by mid-August.

The lifetime lesson here: At their most dramatic turning points, the economy can’t be forecast, and the market cannot be timed. Instead, having a long-term plan and sticking to it—acting as opposed to reacting—once again demonstrated its enduring value.

(Two corollary lessons are worth noting in this regard. (1) The velocity and trajectory of the equity market recovery essentially mirrored the violence of the February/March decline. (2) The market went into new high ground in midsummer, even as the pandemic and its economic devastations were still raging. Both outcomes were consistent with historical norms. “Waiting for the pullback” once a market recovery gets under way, and/or waiting for the economic picture to clear before investing, turned out to be formulas for significant underperformance, as is most often the case.)

The American economy continued to demonstrate strong resilience through the balance of the year, such that all three major stock indexes made multiple new highs. Even cash dividends appear on track to exceed those paid in 2019, which was the previous record year.

Meanwhile, at least two vaccines were developed and approved in record time and were going into distribution as the year ended. There seems to be good hope that the most vulnerable segments of the population could get the vaccines by spring, and that everyone who wants to be vaccinated can do so by the end of the year, if not sooner.

The second great lifetime lesson of this hugely educational year had to do with the presidential election cycle. To say that it was the most hyper-partisan in living memory wouldn’t adequately express it. In the event, everyone who exited the market in anticipation of the election got thoroughly (and almost immediately) skunked. The enduring historical lesson: never get your politics mixed up with your investment policy.

Still, as we look ahead to 2021, there remains far more than enough uncertainty to go around. Is it possible that the economic recovery—and that of corporate earnings—have been largely discounted in soaring stock prices, particularly those of the largest growth companies? If so, might the coming year be a lackluster or even a somewhat declining year for the equity market, even as earnings surge?

Yes, of course it’s possible. Now, how do you and I—as long-term, goal-focused investors—make investment policy out of that possibility? My answer: we don’t because we can’t. Our strategy for 2021 is driven by the same steadfast principles as it was a year ago—and will be a year from now. We tune out the “noise.” We act; we do not react. This was the most effective approach to the wild swings of 2020, and I believe it always will be.