As an advisor, one of the questions I’ve helped address with clients is, “How do employee stock options work?” Employee stock options (ESOs) are a type of compensation that some employers grant to their employees. ESOs give employees the right to purchase shares of their company stock at an agreed-upon price and future date. ESOs can be a great way for employees to buy an equity stake in their company at a discount. While popular with younger startup companies who may not have the cash to attract and retain the best talent, some bigger companies also offer stock options. ESOs provide an incentive for employees to work harder to ensure company profitability since they now have “skin in the game.” ESOs can also encourage employee longevity. Since the options usually vest over a staggered period of time, employees may have an incentive to stay with the company longer.

There are two types of ESOs: Incentive stock options (ISOs) and non-qualified stock options (NSOs). Each option type is taxed differently. Before exploring an example to illustrate how ESOs work, let’s familiarize ourselves with some basic terminology:

- Strike price – the price that you can purchase the stock, according to the ESO plan document

- Fair market value (FMV) – the price of the stock on the date you exercise or sell the shares

- Bargain element/Spread – the difference between the strike price and the fair market value

- Basis – the price you paid for the stock. This is used to calculate capital gains.

- Grant date – the date the company awards you the ESOs

- Vesting date – the date you can exercise your options

- Expiration date – the date by which you must exercise your options, or they will expire

Basic example of how ESOs work

“Lisa” is issued 100 ESOs for Company ABC on July 1st, 2019 with a strike price of $50, and a vesting date of July 1st, 2020. If ABC stock is trading for less than $50 on July 1st, 2020, Lisa will simply let the ESOs expire worthless. If ABC is trading for more than $50 (let’s assume $100 per share), she will be able to exercise the options and buy 100 shares of ABC for $5,000. At that point, Lisa can either keep the shares and hope they continue to go up in value, or sell them now for $10,000, netting a $5,000 profit. What if Lisa does not have the $5,000 available to buy the shares? In this case, she could potentially do a “cashless exercise.” In this scenario, Lisa would borrow $5,000 from the broker where the options are held and buy the 100 shares. She would then need to sell the shares (for $10,000 in this case) on the same day, repay the $5,000 loan to the broker, and keep the $5,000 profit.

Taxation of ESOs

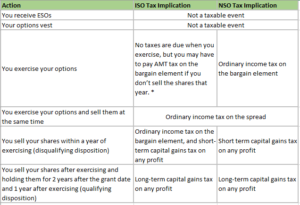

Exercising and selling ESOs can have different tax implications depending on whether they are ISOs or NSOs, and when you sell them. This chart provides an overview:

* Note about exercising ISOs: When you exercise ISOs, the price you pay for the shares will become the basis used to calculate the AMT tax that may apply when you sell the shares. It is extremely important to do careful tax planning around ISOs. Here is a more detailed discussion of ISO taxation.

As you can see, taxation of ESOs can get complicated, so it is very important that you fully understand the tax ramifications of any action you take. Triggering capital gains or income tax needs to be weighed carefully against the real value of the stock shares. If there is not a market to sell them in (i.e., the company stock is not publicly traded) you need to ask yourself if you want to pay tax for something now that could become worth substantially less later. We typically advise clients that if they are going to pay tax, they should have something to show for it now.

Even if your company stock shares are publicly traded, it may be worth selling them immediately and investing the proceeds in a more diversified manner, like an S&P 500 index fund. Though selling the shares within one year may mean paying more in capital gains taxes, it could be worth eliminating the market risk of owning too much of one stock. Your company stock could decline significantly in value, and you will have paid taxes based on the higher value. Also, it is not ideal to have too much of your financial well-being tied up in one company. We believe diversification is the best way to minimize risk with your finances. You are already dependent on the company for your salary.

Similar to ESOs, Restricted Stock Units (RSUs) are another form of employee compensation that some companies offer. RSUs are shares of company stock issued to an employee within the guidelines of a distribution schedule. RSUs are often contingent upon reaching certain performance goals or employee tenure. Once they vest, a portion of the shares are withheld for taxes (ordinary income), and the employee receives the remaining shares. At this point the employee can sell the shares and invest the proceeds in their diversified portfolio.

Conclusion

We hope that this information has answered the question of, “How do employee stock options work?” ESOs and RSUs can be a great addition to your overall compensation package. However, they should be evaluated carefully before acting on them. It is also important not to simply ignore key dates because you cannot decide what to do with your shares. Your personal circumstances, the specific plan available to you, and many other factors need to be addressed before acting on stock options or shares. As always, it a good idea to seek assistance from a financial advisor in Austin about complicated financial matters.

We are always here to help you with these topics and any other financial questions you that and your family may have. Please contact us to schedule a complimentary consultation.

Want more great articles on investment topics? Subscribe to our monthly Wealth Management newsletter for relevant articles about investment topics written by our advisors. Click here to sign up!