Time to review your property and casualty policies

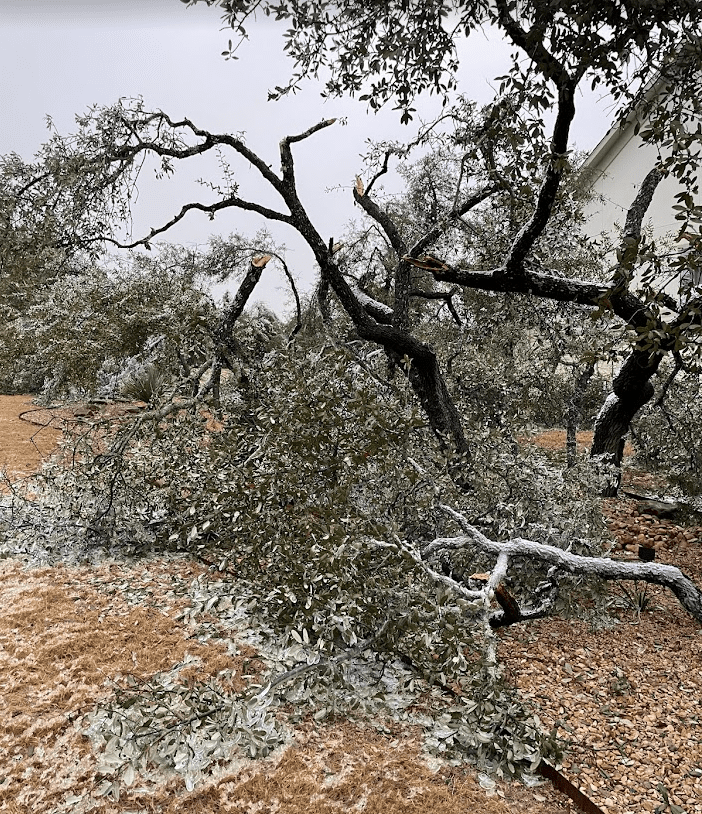

The past few weeks have brought back a familiar form of chaos. Just as many Austinites were recovering from the stress of 2021’s Winter Storm Uri, another storm came in to remind us of the destructive power of winter weather. The ice storm of late January and early February 2023 was the worst icing event in the region in more than 15 years. The weather was severe enough that it downed trees areawide and left hundreds of thousands of Central Texas without electricity.

Given that these recent events have wreaked havoc in the area, I wanted to turn to a local insurance expert for some useful tips to scrutinize your current insurance coverage and to protect yourself against future major damage from snow and ice storms. Here are some tips stemming from my conversation with Virginia Tilley of Marsh McLennan Agency’s Private Client Services Group:

What is Property & Casualty (P&C) Insurance

Don’t worry- you are not alone if you are not completely familiar with insurance terms and jargon. Property & Casualty (P&C) insurance is simply a name used to describe several types of insurance policies. Property insurance provides coverage to protect the things you own. This could include assets like your home, car, and other possessions. Casualty insurance protects you from liability and covers the risk of loss in the event you cause damage to another person’s property or injury to them personally.

Tips on Property & Casualty Insurance

This most recent storm has many people examining how their P&C coverage works or if there is anything that can be done to manage future losses.

- Always document any damage before you do anything. Make sure you have pictures and videos of any damage done to autos, homes, and other structures before moving debris.

- If damage is extensive, call your insurance agent as soon as possible.

- In general, insurance companies only cover debris/tree removal if they land on your home, a covered structure, or block a driveway. This coverage is also subject to a Homeowner’s deductible. However, making a claim will impact your policy at renewal. So, before you decide to file a claim with your insurance, get estimates from a tree removal service/contractor for repairs and be sure to save all your receipts.

- Have trees trimmed by an arborist on an annual basis and hire a licensed roofer to inspect for damage before filing any claims.

- Water claims are still the leading cause of loss in the industry. A water leak detection/shut off system is a good option to mitigate this risk.

Ways ML&R Can Help You with Property & Casualty Insurance

Even if you were lucky enough to avoid sustaining any major damages during this last storm, it is still good practice to work with your financial advisor to scrutinize your current Property & Casualty (P&C) policies to keep up with any potential changes in coverage. Below are items that our ML&R team can help you review to ensure that your current risk management plan still fits your needs.

Homeowners Insurance:

Homeowners insurance protects your home and its belonging against covered perils, or events that your insurance will cover. This could include a lightning strike, fire, theft, vandalism, wind, or hail damage.

Policy items to review:

- Is your dwelling and personal property covered on “all risks” basis? (This is a type of insurance that automatically covers any risk that the contract does not explicitly exclude.)

- Do you have full replacement coverage? (If your property is destroyed, the insurance company is obligated to fully replace or rebuild your property without any deduction for depreciation.)

- Do you have adequate contents coverage?

- Are there any significant exclusions? For instance, most homeowners policies do not provide protection for events such as flood or earthquake.

- You may consider adding additional coverage for backups of sewage and drains as well as primary flood coverage.

Auto Insurance:

Auto insurance covers damages to your vehicle, your passengers and other people resulting from an accident that you cause.

Policy items to review:

- Are all of your vehicles listed? Are recreational vehicles and watercraft also considered?

- Are all drivers listed? (For instance, most companies will require teens with a permit to be added as a driver.)

- Do you have enough liability coverage? (For the best protection, it is advisable to include an umbrella policy as well.)

Umbrella Insurance

Umbrella insurance provides liability coverage above the limits covered by your homeowners and auto policies. My colleague, Rachel Roth, recently provided an informative overview on the purpose and benefits of umbrella insurance here.

Policy items to review:

- Do you have sufficient coverage? (Umbrella coverage is inexpensive yet incredibly important to have as part of your risk management plan.)

- Do you have any liability gaps that exist between your homeowners/auto and umbrella policy?

- If you have them in place, ensure your Living Trust and/or LLCs are named as an “additional insured” to cover assets titled to your Trust/LLC.

Other Items to Look Out For:

- Are multiple properties in multiple states coordinated?

- Are international properties covered in the insurance program?

- Check for “Valuable Articles” policies. Many personal property coverage amounts contain limits for certain items such as jewelry, fur and silverware and are subject to your homeowners deductible.

- Are any memberships in fractional aircraft groups considered for personal liability risks? It’s possible a non-owned aircraft policy may be needed.

- On an ongoing basis, inventory your special and valuable property items. If necessary, secure an appraisal for such articles.

- Pay attention to deductibles. Deductibles are a personal choice. The higher the deductible, the lower your insurance cost.

At ML&R, we are here to help you think through your entire financial plan, including your risk management needs. We welcome the opportunity to help you understand your Property & Casualty policies, assess your risk management gaps, and connect you with trusted insurance experts and resources.