Happy National Women’s History Month! It is hard to believe it has already been one year since the last time we celebrated the amazing accomplishments of women throughout history and further empowered women of today.

At ML&R Wealth Management, we know that women have unique needs as it relates to financial planning and investing. There are many hurdles we must overcome, as we plan for our financial success. We understand not only the wage gap but the investment gap that impacts women of today. We live longer, continue to deal with earning less, and tend to invest differently than men. This creates a challenging financial dynamic that we are experienced in navigating for our clients. Working with our team means you are working with a wealth management firm with a deep bench of women financial advisors that are acutely aware and familiar with financial planning for women. We help women build and maintain a financial plan along with helping women avoid common financial planning mistakes so that they can maximize their potential for success.

Each week during the month of March, our team of women financial advisors will answer questions from the women of our community in our special blog series, “A Woman’s Guide to Investing”. We want to thank all the women who sent in questions. Because of you, this special series is possible. If you are reading this and have a question of your own, you can submit it here. We will make sure to answer it for you!

To kick off our series, this week we will discuss an often overlooked and important part of estate planning as it relates to blended families.

Q: “I am on my second marriage and have children from a prior marriage. While I love my husband, I want to make sure the investment account I inherited from my parents goes to my two adult children when I die. How do I make that happen?”

This is a great question. Before I begin, it is important to point out that you should always consult an attorney for legal advice with regard to implementing an estate plan. As comprehensive Wealth Advisors, we can provide guidance given your overall financial goals and work alongside the attorney of your choosing to ensure all goals align.

The conversation around planning for our own death is often an uncomfortable experience, especially when it comes to separate property and blended families. Blended families inherently face their own challenges. Throw in a conversation about money and death, and it will surely bring about challenges and stir up many emotions that many folks just wish to avoid. While the conversation may be uncomfortable at times, it certainly is a must, along with proper legal documentation if you have specific desires for how your assets shall pass upon your death.

The ultimate goal of estate planning is to make sure your assets pass according to your wishes. When someone dies without doing any estate planning, (i.e., without a Will) unfortunately, the state laws in which you reside will dictate how your assets are split among your surviving spouse and heirs. Keep in mind, each state has different laws and could dramatically impact the distribution of your assets.

Before diving into the details of how this could potentially play out in the event you die without a Will, it is crucial to point out that any separate property that is intended to remain separate (i.e., meant to pass on to the person of your choosing in this case) should never be commingled. What this means is that you should not take separate assets you inherited from your parents and move them into a joint account or joint titling with your spouse. If you receive an inheritance during your marriage, keep it in your name only… AND MAKE SURE YOU HAVE A WILL. This will also serve you well in the event your marriage ends in divorce.

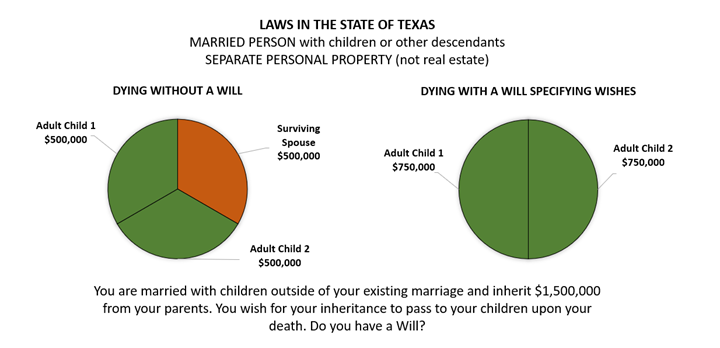

In the state of Texas, with a blended family (i.e., you are married to someone who is not the parent of your children), if you die without a Will, your children will NOT receive 100% of the inherited personal property you kept separate even if you intended for that to happen. According to state law, they will only get two-thirds, split evenly between them, while your surviving spouse will get one-third. There are other laws related to community property and separate real property (real estate), but for the purpose of this question, we will focus on the separate personal property.

EXAMPLE

Let’s use an example to illustrate this concept. Let’s say you remarried after your two kids went to college and have been happily married for twenty years in the state of Texas. Throughout your marriage, you built a life with your spouse both personally and financially. From the financial perspective, you purchased your home jointly with rights of survivorship, you had your retirement accounts fully funded and listed each other as beneficiaries, all vehicles were jointly owned, and you even had a joint investment account together. Fifteen years into your marriage, you inherit an investment account (personal property) worth $1,500,000 from your parent’s estate and it goes into a separate investment account in your name alone. From day one, you knew you wanted to keep this money set aside for your adult children (from a previous marriage) after you pass since you and your current spouse built your own nest egg together outside of this.

Conversations were had with both your children, other family members, and even your spouse who agreed to and understood your wishes. Life was busy and the days and years went on, and while your intention was good, you never actually pulled the trigger on creating a Will. In addition, no one ever informed you that you could add beneficiaries to your individual investment account just like you can with your retirement accounts. The unfortunate day comes, and you pass on leaving behind your spouse and two adult children from a prior marriage.

AS INTENDED: Your surviving spouse will receive all your jointly owned property and any accounts that you listed them on as a beneficiary, essentially the nest egg you built together.

NOT AS INTENDED: Per the state laws, your surviving spouse is also entitled to a portion of the inheritance that you desired so much to stay in your family.

The way the law shakes out in Texas for separate personal property, when married with children, is that one-third, or in this example, $500,000 will pass to your surviving spouse, while your children will split the remainder at $500,000 each. That is a lot of money that will go to someone you did not want it to go to.

Keep in mind, for blended families, all states have their own laws for someone dying without a Will. Some are more friendly to the surviving spouse while some are more friendly to the children. Make sure you check into this for whichever state you reside in.

We all know someone who has experienced the nightmare of dealing with the unintended consequences of gaps or holes in a loved one’s estate planning. In this example, while we would want to think our surviving spouse would do the right thing based on your conversations with them and disclaim their interest to your children, the fact remains that the large majority of people do not do this.

IN CONCLUSION

To help simplify how to approach any inheritance you might receive during your marriage, below is a list of specific tips to get you started thinking about what might work best for you and your situation.

- Start with always keeping inherited assets separate by keeping it in your name alone.

- Have a Will that specifically outlines your wishes.

- An alternative is to name a beneficiary on your investment account that you inherited. This typically overrides any instructions in a Will AND it won’t have to go through probate.

- Put the assets in a trust. You can even set it up so that your surviving spouse benefits from the income of the trust while they are still alive, but then passes to your children at the death of your surviving spouse.

- Have open and honest conversations with your family members that might be impacted by this decision.

As always, we recommend working with professionals to help guide you during this part of your financial journey. At ML&R Wealth Management, we would be happy to discuss your goals, provide guidance, and work with your attorney so that you can execute a solid estate plan.

At ML&R Wealth Management, with our team of women financial advisors, we have the expertise and understanding to help you put a plan in place so that you can build your wealth, protect your wealth, and maintain your wealth throughout your entire financial journey. Contact us to learn more.