At ML&R Wealth Management, we know that women have unique needs related to financial planning and investing. We must overcome many hurdles as we plan for our economic success. We understand the wage gap and the investment gap that impacts women of today. We live longer, continue to deal with earning less, and tend to invest differently than men. Gaps create a challenging financial dynamic that we have experience navigating for our clients. Working with our team means you are working with a wealth management firm with a deep bench of women financial advisors that are acutely aware and familiar with retirement for women and financial planning for women in general. We help women build and maintain a financial plan along with assisting women to avoid common mistakes so that they can maximize their potential for success.

Each week during the month of March, our women financial advisors will answer questions from the women of our community in our special blog series, “A Woman’s Guide to Investing.” We want to thank all the women who sent in questions. Because of you, this unique series is possible. If you are reading this and have a question, you can submit it here. We will make sure to answer it for you!

In week two, we will answer a question on the variety of ways you can maximize your household retirement savings if you are maxing out your 401k and your spouse doesn’t have access to a 401k. We hope this post helps answer your questions related to retirement for women!

Q: “Your husband doesn’t have a 401k, and yours is maxed each year; what are some good ways to save for retirement for him?”

This might be a common issue with a stay-at-home dad, a self-employed husband, or an employed husband who doesn’t have access to an employer-sponsored retirement plan (401k). However, he has several options to save for retirement regardless of which bucket he may fall in.

The general rule is that if a couple files their taxes jointly, and only one spouse has access to a 401k or other employer-sponsored plans, the spouse without access to the plan can open and fund a Roth IRA or Traditional IRA, assuming they do not exceed the income limits. So, for example, if your total modified adjusted gross income (AGI) falls below $214,000 and you file your return jointly, your spouse without access to a 401k plan may:

- Make a fully deductible Traditional IRA contribution if your modified AGI is $204,000 or less

- Make a partially deductible Traditional IRA contribution if your modified AGI is between $204,000 and $214,000

- Make a full Roth IRA contribution if your modified AGI is $204,000 or less

- Make a partial Roth IRA contribution if your modified AGI is between $204,000 and $214,000

- If modified AGI is over $214,000, you may not contribute to a Roth IRA

An example always seems to help. So here are a few different scenarios to show the other options.

The wife maxes out 401k, and the husband stays home with kids; AGI is LESS than $214,000 per year.

In this situation, your husband is allowed to open a Traditional IRA in his name and make deductible contributions (full or partial depending on income level; up to $6,000 per year if under age 50 or up to $7,000 per year if 50 or older) since he does not have access to an employer-sponsored plan and doesn’t earn an income. Even if you make the money, the contributions can go into his IRA. Keep in mind that the account is an individual account which means you cannot own it jointly.

The wife maxes out 401k, and the husband stays home with kids; AGI is MORE than $214,000 per year.

Unfortunately, in this situation, your husband would not be able to make a deductible Traditional IRA contribution or make any Roth IRA contributions since your modified AGI is over the income limits. You can still contribute to the Traditional IRA, but the contribution will not be deductible. We often don’t recommend this strategy since the recordkeeping for this can be daunting.

In this situation, it often makes sense to open a separate brokerage account earmarked for your husband’s retirement. Commit to a monthly savings amount (any amount you want) and have it automatically drafted on the same date every single month. There is consistency and frequency with contributions, just like a 401k. Your employer may even allow you to set up a direct deposit for a specified dollar amount to this investment account. This is helpful if you would like to avoid seeing this money deposited into your bank account first.

Keep in mind that this option does not have the same tax deferment or exemption as a Traditional or Roth IRA. Any investment income or realized capital gains throughout the year will be taxed in the year it occurred. On the plus side, if it is earmarked for retirement, distributions are not taxed as ordinary income as in a Traditional IRA once you need it to live on. I would take that as a major plus!

The wife maxes out 401k; the husband is self-employed and doesn’t have access to a 401k.

If your husband is self-employed, he has many options depending on his income level, whether or not he has partners, and whether or not he has employees. The great news is that because he is self-employed, the retirement savings options would not be limited due to your total income.

- IRA Contribution: The first option is to contribute up to $6,000 per year if under age 50 ($7,000 if 50 or older) to a Traditional IRA or Roth IRA assuming you qualify based on income limits.

- SEP IRA: The second option is to contribute to a SEP IRA. He can contribute 25% of his income, up to $61,000 for 2022. All tax-deferred. If he has employees, he would be required to make contributions for them (employees acannot make contributions), which may not be ideal. Be sure to look into this before setting up this type of plan if this is the case.

- Solo 401k: The third option is to contribute to a solo 401k. Assuming he has no employees, he can contribute up to $20,500 for the employee portion (assuming there is earned income to cover this), and then a profit-sharing (employer) contribution up to 25% or 20% of the wages or net income (respectively) depending on whether his company is a corporation or a sole proprietor/partnership. In addition to this, your husband can make a catch-up contribution if he is 50 or older. Catch-up contributions are not allowed in the case of a SEP IRA. Therefore, the maximum contribution he could make with a solo 401k is also $61,000 (under age 50) or $67,500 if he is 50 or older.

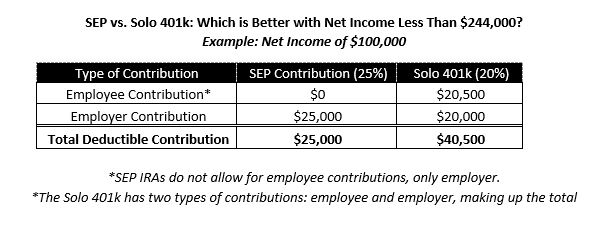

At first glance, it may seem that the SEP and solo 401k are equals in terms of contributions. However, the solo 401k makes more sense if your husband’s net income is less than $244,000 per year and is age 50 or older.

Here is a table showing the benefit of the solo 401k over the SEP if your husband’s net income is $100,000 as a self-employed person and is under age 50. This example assumes his company is a sole proprietorship or partnership (i.e., not a corporation). If it is a corporation (like an S Corp), the employer contribution would be 25% of the W2 wages he pays himself rather than the 20% of net income from the flow-through earnings.

SIMPLE IRA: If your husband is self-employed and does have employees, a better option may be a SIMPLE IRA. If he has less than 100 employees, a SIMPLE IRA is easy to set up, and each employee owns the accounts. The contributions are significantly lower (up to $14,000 in 2022, plus catch-up contribution of $3,000 if 50 or older). The employees make their contributions, but employers generally make either a match of up to 3% of employee compensation or a fixed contribution of 2% for every eligible employee.

Cash Balance Plan: If your husband is self-employed and has no employees but is very high income and is looking for a significant tax deferral, a cash balance plan may be his best bet. Even if he has employees, he can still set up this plan. However, it can become costly to do so. This is a defined benefit plan in which the contribution is calculated based on the benefit you will receive at retirement, your age, and expected investment returns. An actuary must calculate the contribution amount, which means more significant administrative needs than other options. However, the tax deferral is enormous in many cases. Some individuals can contribute over $100,000 annually, all tax-deferred, depending on their age and income. This is a fantastic option for high-earning self-employed individuals looking for as much tax deferment as possible.

The wife maxes out 401k; the husband is employed but doesn’t have access to a 401k or other employer-sponsored plans.

In this situation, your husband’s options are similar to the options listed for stay-at-home dads. He may contribute to a Traditional IRA or Roth IRA assuming you qualify based on income limits.

If your modified AGI is too high to contribute to either type of IRA, you can always set up a separate brokerage account and earmark it for his retirement.

Retirement for women can be complicated if only one of you has access to an employer-sponsored retirement plan. However, one option may be better than another, depending on your situation. Working with a Financial Advisor can help you and your family make the right choice to maximize your retirement savings. At ML&R Wealth Management, we are experienced in these matters and can help you and your family reach your fullest financial potential by understanding your unique situation, listening to your goals, and building a solid financial plan. If you want to explore your options, please reach out to us here.