Answering Common Questions to Avoid Derailing Your Financial Goals

It certainly has been an interesting time for the world. We are in the midst of a global pandemic that has impacted every person in one way or another. We are being told to halt our lives so that we can protect the most vulnerable. Our health care systems are being stretched thin, our grocery store workers are being hailed as heroes for keeping the shelves stocked day in and day out, and our investment accounts are suffering considerably as the coronavirus spreads across the globe. The routine of our daily lives has been uprooted and we are all being forced to adapt, deal with the unknown, and forge ahead without any clear ending in sight.

As investors, our emotions are at the forefront of this battle. While we are all trying to keep our families safe and our work uninterrupted, we are also struggling to manage the anxiety and stress that comes with a 30% drop in the market with no clear end in sight. For many, it feels like uncharted waters. For others, they are grappling with the feeling that “it feels different this time”. Regardless of how you are feeling, the emotional pull and the very personal connection we all have to our money is very real and very raw during times like these.

As trusted advisors, we understand your fears, concerns, and anxieties. We recognize the emotional triggers that money and finances can bring. There is a personal connection between your money, your goals, and your own sense of success and accomplishments. When something outside of your control threatens all that you have personally built, it becomes emotional. As trusted advisors, we are also here to be the voice of reason. It is our job, and for many of us our sense of duty, to arm you with all of the knowledge and tools that we can to make sure you make the very best financial decisions now, during these turbulent times, so that you stay disciplined and don’t derail your financial goals.

At ML&R Wealth Management we have been spending a tremendous amount of time over the last few weeks addressing our clients’ questions, monitoring their portfolios, and being the voice of reason for many. With full recognition of how you may be feeling about your portfolio, below are our thoughts on how to survive a global financial crisis and the most common questions we are getting from our clients.

Should I Reduce My Stock Exposure?

In order to address this question well, it is important to understand the emotional human nature of investing. When we are in challenging times, facing rapidly evolving information, the market naturally becomes more volatile. Many investors struggle to separate their emotions from what is happening in their portfolio. When the market is good, investors tend to be more optimistic and more willing to put money in. On the other end, when markets are bad, investors become fearful or even in some cases, panicked, which can result in poor decisions at the absolute worst times.

Because we are in a downturn, it has many wondering if they should reduce their overall stock exposure to their portfolio. This desire is primarily being driven by the anxiety and stress produced by the current volatility. Try to remember that this is what is planned for when risk tolerance and the initial portfolio allocation are set. It’s easy to think about the upside potential. It’s much harder to be on the opposite end of that. No matter what the stock allocation is set at, if the portfolio is properly diversified, it is built to withstand this volatility in the long run.

If you think about the safest time to get off a rollercoaster, it certainly isn’t while you are on the ride. The same is true for your investments. Making a change to your allocation must be a permanent decision. Making the adjustment today and then reevaluating in three months is a risky chance to take. Essentially, at that point, it would become market timing. The problem with market timing is that you have to be right twice; once when you sell, and once when you get back in. The research overwhelmingly shows that this is a near-impossible thing to do. If you are investing for the long term, then the best thing to do is to stay the course. Once markets stabilize and upon reflecting back, you still think that was too much to bear, then that is a much better time to reduce your overall stock allocation. It isn’t while we are in a downturn.

Is it Different This Time?

Many investors are wondering if this financial crisis is different than any in the past. The answer is yes, it is different, but only because the world is dynamic and is always changing which means with each downturn we experience, it will be different than the last. What is constant is that the market is working exactly as we would expect given the uncertainty in the world. Each day, when new information comes out, the market adjusts to that information.

In reviewing the last seven financial downturns, we see similarities between all of them as it relates to recovery. Each downturn has its own reason for occurring, each has its own length of time to last, and each has its own recovery time. However, what is most important to point out, is that there was a positive subsequent return one year after each bottom in all but two. In all seven, there was a positive subsequent return after three and five years. Although a global investment strategy with 60% stocks and 40% bonds suffered losses immediately following the specific events, the financial markets recovered relatively quickly.

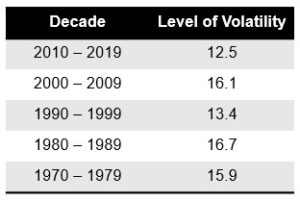

In addition, there could be an argument made that the last decade was the outlier, rather than the financial crisis we are experiencing today. This can be quantified. Below shows the level of volatility for each decade going back to the 1970s. The higher the number, the greater the volatility. What this tells us is that each decade has its own major event that brings high levels of uncertainty. It is very likely that the reason it feels different this time is because we have been on an upward trend with little relative volatility for the last ten years. It’s easy to forget how painful the financial crisis of 2008-2009 was when we are so far removed from it with few reminders along the way.

Source: Dimensional Fund Advisors

It is important to remember that the stock market can be wildly different from day to day and year to year. Even in years with high calendar-year returns, a large intra-year decline may have occurred. An example of this is in 2009, the US Market had a calendar year return of 28.34%. The largest intra-year decline was 27.42%, while the largest intra-year gain was 72.50%. While each financial crisis looks different, having a long-term strategy and staying disciplined pays off and helps to ride out the storm. The important thing to remember is that if you are invested for the long term, all that is going on right now is just noise. You don’t need the money right now, so put it out of sight and out of mind.

Is Now a Good Time to Buy Stocks?

Whenever there is a downturn in the market, one of the more common questions we get is whether it makes sense to buy more stocks. Based on historical return data we would say that any time is a good time to invest. In general, as an investor, individuals invest to get a positive return. The investor receives this return because they are willing to take on risk. Otherwise, they would just purchase T-bills at the risk-free rate. The interesting outcome, no matter when they purchase, based on historical return data, the average subsequent return is positive. Even when the market is at an all-time high, the average subsequent return is still positive. Rather than trying to time the bottom or stress out on when the right time to buy more stocks is, know that on average, the return data is in your favor.

In Conclusion

It is perfectly natural to experience stress and anxiety during a financial crisis. Working with a Financial Advisor that has your best interests at heart can help you maintain the discipline that is required to stay on course. At ML&R Wealth Management we are here for you during these tough times so that you can focus on what matters most. We hope the information on how to survive a global financial crisis has been helpful. Contact us for more information on this topic or any other..

Below is a helpful video that talks you through the diagrams and graphs.