This past Monday, March 9th, marked the 11th anniversary of the crescendo of the global panic that marked the bottom of the bear market of 2007-09. It is a wonderful irony that the world has elected to celebrate this iconic anniversary with another epic global panic attack. As we all know by now, the precipitants of this decline have been:

(a) the outbreak of a new strain of virus, the extent of which can’t be predicted,

(b) the economic impact of that outbreak, which is equally unknown, and

(c) most recently, the onset of a price war in oil.

The common thread here is the unknown: we simply don’t know where, when, or how these phenomena will play out. We have no control over the uncertainty, BUT we can and should have perfect control over how we respond to it.

Avoid Panic

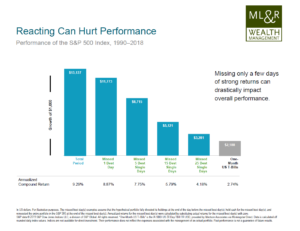

Sometimes, the best thing to do is to silence the inner voices of panic and fear and do nothing. Although our inclination may be to sell everything to move to safer assets such as cash, reacting to a crisis by leaving the market is just another form of market timing. When investors move in or out of the market in response to an event, investors are often reacting too late. It’s usually after markets have already gone down that they flee, turning a temporary decline into a permanent loss. In addition, if you flee the market after a major crisis, you must then decide when to return to stocks. In many cases, the decision to reinvest comes after a rebound has already begun, resulting in a missed opportunity. Studies have shown that missing just a few strong days in the market can really inhibit the ability to recoup losses. Moving in and out of the market can also incur additional costs and have potential tax implications for investors.

Maintain Diversification & Long-Term Perspective

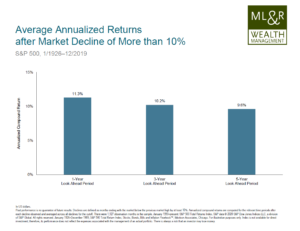

The covid-19 impact on global stock market situation will continue to play itself out, as have all the numberless crises that have gone before it. The lesson of past health crises, such as the SARS, Ebola, and swine-flu outbreaks earlier this century, and of major market disruptions, such as the global financial crisis of 2008–2009 is that markets eventually recover. Negative events such as these may tempt investors to flee the financial markets, but diversification- through a combination of globally diversified stocks and bonds- and a long-term perspective can help us apply discipline to ride out the storm.

Rebalance Your Portfolio

There is a phrase often used when markets go haywire that investors are “dumping or fleeing stocks.” This creates this false depiction that there somehow are thousands of orphaned stocks out there, but for every stock seller, there is a buyer on the other side of the trade. These buyers typically include long-term investors who are often engaging in disciplined rebalancing of their portfolios. This is the process by which you move some gains from assets that have done relatively well in your portfolio (recently this would likely include asset classes such as bonds) and reinvesting those gains in the losers in your portfolio (recently this would likely include stocks). This creates a disciplined process to consistently and systematically “sell high and buy low” and snatch up stocks at a discount.

Lean on a Trusted Advisor

Part of being able to avoid giving in to emotion during periods of uncertainty is having an appropriate asset allocation that is aligned with your willingness and ability to bear risk. Creating a portfolio that investors are comfortable with, understanding that uncertainty is a part of investing, and sticking to a plan may ultimately lead to a better investment experience. Financial advisors in Austin at ML&R Wealth Management are trained to consider a wide range of possible outcomes, both good and bad when helping an investor establish an asset allocation and plan. Those preparations include the possibility, even the inevitability, of a downturn, like the covid-19 impact on the global stock market.

It remains impossible to predict when and how this problem will be resolved. As difficult as it may be, you should take your focus off the catastrophist headlines and put it where it belongs: (a) on your goals and (b) on your long-term plan for the achievement of your goals. When investing, we should be guided by history as opposed to headlines. When people say “This time it’s different,” we respond instead with “This too shall pass.”

Want more great articles on investment topics? Subscribe to our monthly Wealth Management newsletter for relevant articles about investment topics written by our advisors. Click here to sign up!