Our role as Wealth Management Advisors is to help our clients on a holistic level. While a significant portion of this is investment management, an additional component is the tax planning involved year in and year out. It is always our goal to help our clients manage their wealth in the most tax efficient ways possible. Among the many tax and surprisingly, estate planning strategies, one of the more powerful can be a Roth Conversion. There are many benefits to converting Traditional IRAs to Roth IRAs. There are also types of clients it makes sense for and some it doesn’t make sense for. In this article, we have your guide to roth conversions. First, let’s take a look at what a Roth Conversion is and how it works.

What is a Roth Conversion?

A Roth conversion is when money is converted from a Traditional IRA (distributions taxed as ordinary income) into a Roth IRA (distributions never taxed as long as the 5-year rule has been met). Since money in a Traditional IRA must be taxed as ordinary income upon distribution, when money is converted to a Roth IRA, it can provide long term tax savings since the Roth IRA will never be taxed (once the 5-year rule has been met). This can be an incredibly valuable tax and estate planning tool for certain clients.

What are the differences between a Traditional IRA and Roth IRA as it relates to a conversion?

There are a few important characteristics of both a Traditional IRA and Roth IRA that can help clients navigate the difference between the two as well as determine whether or not it makes sense to convert.

Traditional IRAs:

- Contributions are made with PRE TAX dollars. The tax benefit is realized up front by lowering the taxable income for that year if deductible contributions are made. This also means that any rollovers from an employer-sponsored 401k (as long as it is not a Roth 401k) can go into an IRA without creating a taxable event.

- Because the contributions are made with PRE TAX dollars, eventually the money will be taxed as ordinary income once distributions start. If the rules are followed the tax is deferred until then. For many, this means that it could be decades before they are ever taxed on their IRA.

- Traditional IRAs have a required minimum distribution rule (RMDs) which are taxed as ordinary income. As we all know, there is no such thing as a free lunch when it comes to the IRS. To prevent individuals from passing on tax-deferred money generation after generation, the RMD rule was put into place. Basically, whether the money is needed or not, distributions, based on a life expectancy table, are required starting in the year an individual turns 70.5. Or, a client may delay until the April following the year they turn 70.5. A caveat to this is that the RMD may be delayed for the client’s first (and only first) RMD. In addition, if delayed, there is a requirement to take two RMDs in that first year. One for the delayed year, and one for the current year. RMDs play a big role in whether or not it makes sense to do a Roth Conversion.

- Any money in a Traditional IRA that is left to heirs will be taxable to them when distributions are made.

Roth IRAs:

- Contributions are made with AFTER TAX dollars. There is no up-front tax benefit (aside from the tax-free growth of the investments) since the money contributed has already been taxed. This also means that money cannot be rolled over (tax-free) from a traditional 401k into a Roth IRA unless the 401k plan contributed to was also a Roth 401k.

- Because the contributions are made with AFTER TAX dollars, this means that tax is never paid on any distributions (assuming the basic rules are followed and proper age requirements met).

- Roth IRAs DO NOT have required minimum distributions which means NO ordinary income taxation after age 70.5. Because tax has already been paid on the money that went into the Roth IRA, there will never be a time when the IRS requires RMDs out of a Roth IRA (there are different rules for inherited Roth IRAs, but that will not be covered in this article).

- Any money in a Roth IRA that is left to heirs will never be taxable to them when distributions are made.

Given the above, one may wonder why anyone would contribute pretax money versus after-tax money to a retirement account. For the majority of people, their high tax paying years are during their middle to late working years. In order to lower the taxable income during the higher earning years, it is advantageous to put as much money into the tax-deferred account as possible. On the other hand, it might make sense for an individual just starting out to contribute to a Roth 401k or Roth IRA (assuming they are below the income limit) since they are more than likely in a lower tax bracket. As their tax situation changes due to higher income over time, they may decide that a traditional 401k or IRA makes more sense due to the up-front tax benefit. Or, if a client is skeptical of unknown future tax rates, he or she may prefer to have a portion of their contribution go towards a Roth and some towards a Traditional 401k/IRA as a way to hedge against rising tax rates.

Am I a Good Candidate for a Conversion?

What type of client does a Roth Conversion make the most sense for? A Roth conversion can be a great strategy for many types of clients, but the clients who are in low tax brackets after retiring and have a window between when they retire and age 70.5 (when RMDs are required to start in a traditional IRA) tend to benefit the most.

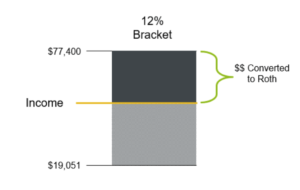

For example, if a client has 10 years until they are required to start taking RMDs from their Traditional IRA and have the ability to live off of income from taxable investments that have preferential tax treatment (capital gains and dividends), their effective tax rate could be very low and provide for an excellent opportunity to start Roth Conversions. With a tax analysis each year, depending on where the client falls in their tax bracket, any ordinary income realized from the Roth Conversion would essentially fill up the remainder of the tax bracket. The chart below helps illustrate this.

By the time they reach age 70.5, a significant portion of their Traditional IRA money is now in the preferred Roth IRA and was taxed in a low tax bracket time frame. This has all sorts of benefits. The first is that if any Traditional IRA money remains, the RMD will be much smaller, which means less taxes. Second, once Social Security kicks in, which can increase your effective tax rate, any additional money needed from your Roth IRA comes out tax-free. Finally, any Roth IRA money that is passed on to heirs will never be taxed to them, unlike with a Traditional IRA.

Another type of client that could benefit from a Roth conversion could be an individual who has decided to go back to school after being in the workforce for several years. Assuming their taxable income is fairly low during that time, they could potentially convert their previous company sponsored 401k to a Roth IRA. The IRS allows a direct conversion from a company plan, regardless of its lack of “Roth” 401k status. The important note here is that you don’t have as much control over tax impact since it would all be converted in the same year. If you rollover a traditional 401k to a Traditional IRA first, you can then spread out your conversion to a Roth IRA over several years to lessen the tax impact each year.

Hopefully, it’s now very clear how powerful Roth Conversions can be for an overall wealth management plan. If you believe you have an opportunity to take advantage of this planning strategy, having a knowledgeable and experienced Austin financial advisor is key to proper analysis and execution. Please feel free to reach out for a consultation if you would like to learn more.

Want more great articles on investment topics? Subscribe to our monthly Wealth Management newsletter for relevant articles about investment topics written by our advisors. Click here to sign up!