If you’re an employee of a publicly traded company, you may have heard of restricted stock units (RSUs) as a form of compensation. But what exactly are RSUs, and should you sell them right away? In this article, we’ll provide an overview of RSUs and help you make an informed decision about when to sell.

What are RSUs?

RSUs are a form of equity compensation that are commonly used by companies to attract and retain employees. Unlike stock options, which give employees the right to purchase company stock at a set, and often discounted price, RSUs give employees a grant of actual company shares. However, the shares are restricted until a certain date (vesting date) and/or until certain conditions are met, such as the employee reaching a certain tenure with the company or the company achieving certain financial goals.

When can you sell RSUs?

Once the shares underlying your RSUs are no longer restricted and they are vested, you are free to sell them. The timing of when your RSUs vest and become unrestricted depends on the terms of your grant.

Should you sell RSUs right away?

The decision of whether to sell your RSUs right away depends on your individual financial situation and goals. Here are a few factors to consider:

- Diversification: If you’re heavily invested in your company’s stock, selling your RSUs can be a good way to diversify your portfolio and reduce risk. Afterall, your human capital is currently tied to this company and including these shares only increases it which can be risky. Consider this example. Let’s say the company starts to fall in value. Your shares have also fallen in value and your role at the company is probably also at a larger risk of going away if it is a serious fall in value. Facebook is an excellent example of this. The stock price fell close to 70% during 2022 which was followed by massive layoffs. It’s often best to avoid this level of concentration.

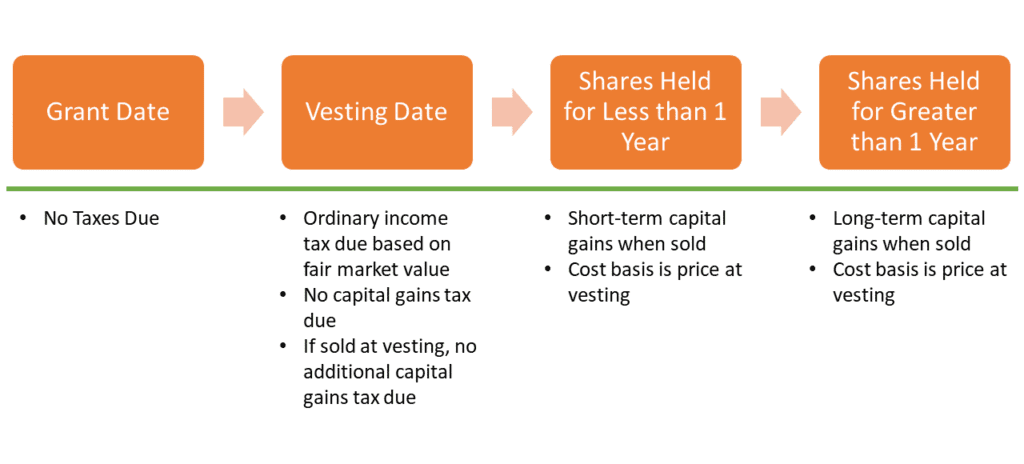

- Taxes: Since you owe taxes at vesting, selling them right away does not cause any additional taxation since in theory it is being sold at the same price as the vesting. If you decide to hold the stock, if there is a gain, you will want to hold it for at least one year to get the preferred long term capital gains treatment. Any gain or loss after vesting is considered a capital gain or loss. You only pay ordinary income taxes on the value at vesting.

- Future potential: If you believe that your company’s stock has strong potential for future growth, you may want to hold onto your RSUs to benefit from that growth. Think long and hard about this option as it can lead to high concentration of the company you work for in your overall wealth. If you are determined to keep shares of your company stock, perhaps only keeping a portion, and then diversifying the remainder is a good balance. This way, your long term goals are satisfied without being too overly concentrated in one company.

- Treat it as a bonus: If your company gave you cash today, would you use that cash to pay for more company stock at the fair market value? If the answer is no, then sell the RSU’s right away and treat it as a bonus. You can use this money to accomplish other short or long term financial goals. Often, we tell our clients to use the cash to redeploy it into their overall portfolio for diversification purposes.

How are RSUs Taxed?

It’s important to note that once your RSUs vest, you will owe taxes on the fair market value of the shares at the time they vest. At vesting, these shares are taxed at ordinary income tax rates. This means they are taxed at the same rate as your salary or wages. You can often elect to have your company sell enough RSUs to pay for the tax so that you are not paying cash out pocket for the tax liability.

Example: Let’s say you are in the 30% tax bracket and were awarded RSUs

- Award: 200 RSUs on December 15, 2021

- Vest Date: December 15, 2022 (Fair Market Value is $5,000 at $25 per share)

- Taxation: $5,000 x 30% = $1,500 tax liability at vesting

- You would need to have your company sell 60 shares to cover the tax liability or you can pay in cash

- You end up with 140 shares ($3,500) after tax is paid

The decision of whether to sell your RSUs right away depends on your individual financial situation and goals. If you’re unsure what to do, it’s always a good idea to consult with a financial advisor. With the right information and guidance, you can make an informed decision that is right for you. At ML&R Wealth Management, we are experienced in helping our clients think through their choices so that they can maximize the opportunity to reach their long term financial goals.