There is a preponderance of evidence supporting the fundamental investment principle that value stocks tend to outperform growth stocks, producing a value “premium.” For example, well-known and respected academics such as Eugene Fama and Ken French have published data and research that spans nearly a century in the US to support the notion that value stocks have higher expected returns relative to growth stocks. Their research further finds that this relationship is not unique to the US stock market. Data spanning almost five decades supports this same investment principal in stock markets outside the US.

Putting recent returns into context.

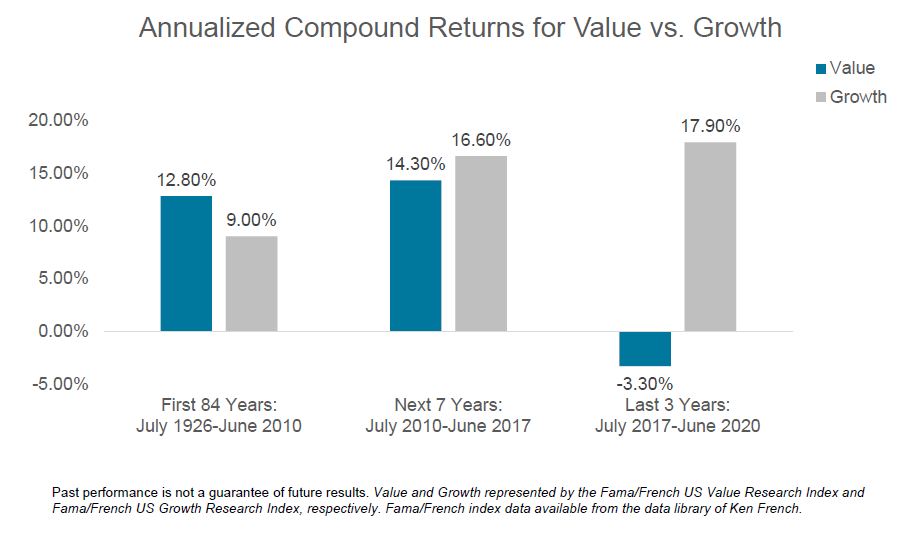

This market premium for value stocks, however, has seemingly been turned on its head as of late. It’s not news to most investors that value stocks have struggled over the past decade. Growth stocks have been on a tear, enjoying a significant run of outperformance versus their value counterparts. This trend emerged as we came out of the Great Recession in 2008/2009, and the recent pandemic has been the equivalent of throwing gas on the fire. But, it’s important to keep recent returns in perspective. Based on the chart below, we see a widening gap in periodic returns for value vs growth stocks in recent years. Over the first seven years of the last decade (July 2010-June 2017), value stocks actually outperformed their prior long-run average return, 14.3% versus 12.8%. However, it was growth stocks that was the outlier. They had above average returns relative to their long-run average (16.6% versus 9.0%) which produced a negative value premium for this period. The last three years were a different story though. While growth stocks continued to produce historically high returns, value stocks produced a return of -3.3%, trailing growth stocks by -21.22% over the period. While growth stocks’ performance was significantly above the historical average, value stocks’ performance was significantly below the historical average.

The ebbs and flows of value performance.

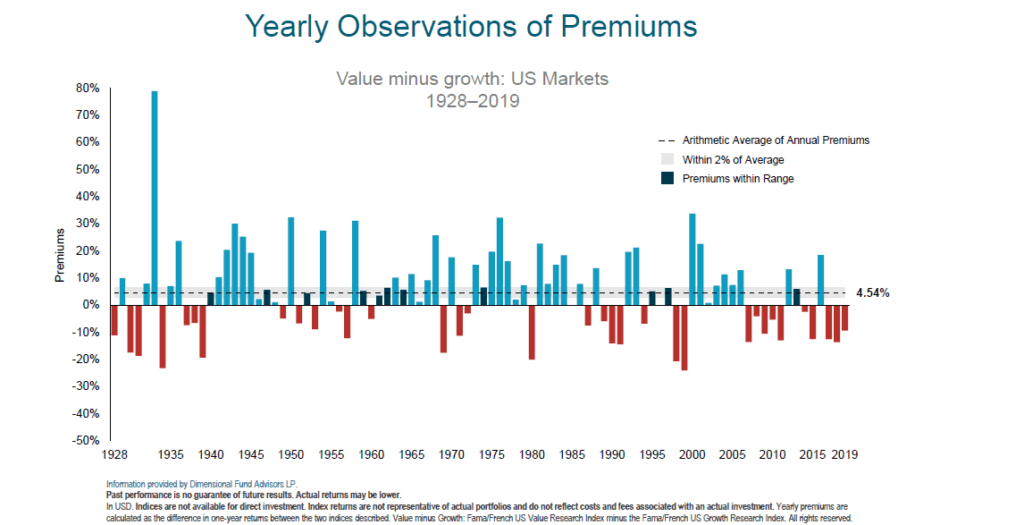

This then begs the question, has something fundamentally changed? Have we entered a “new normal” or a new economy that turns this long-held investment tenet on its head? Not necessarily. In fact, it’s perfectly normal to experience ebbs and flows with value performance. For instance, the chart below documents the annual performance of value stocks relative to growth stocks since 1928. The blue bars indicate years in which value beat growth or produced a positive premium. The red bars indicate when value underperformed growth or produced a negative premium. On average, value stocks have beat growth stocks by 4.54% on an annual basis, but in any given year, the annual value premium has varied. In many cases, it has experienced extreme positive or extreme negative performance relative to growth. Interestingly, the premium has only been within 2% of the long-run average (4.54%) only a handful of times. It is important to note that it has not been uncommon to see consecutive years of a negative value premium before. Moreover, the value premium has been positive more frequently that it has been negative.

Should investors rethink their asset allocation to value stocks?

To say the least, the last several years have been disappointing if not downright painful for value investors. In fact, with the recent uncertainty in markets, investors may feel tempted to jump ship. Maybe all our old economics textbooks are outdated and there is a new paradigm driving investment returns. These are tempting assertions, but we should not forget the useful lessons we have learned in the past.

We know that asset allocation decisions should be based on the rule and not the exception. The recent underperformance of value should not negate the enormous data and evidence we have for a positive value premium. As mentioned before, that data spans almost 100 years in the US and nearly five decades in non-US Markets.

History has also taught us that inevitably the tides will change, and value will eventually take the lead again. Value has trailed growth in the past before rebounding sharply. But just don’t think you can accurately time it. Often, the returns can present themselves in spurts when you least expect them. Logic and history argue for a commitment to value stocks, so investors should maintain discipline to take part when those shares outperform in the future.

We are always here to help you with the topic of value vs growth stocks and any other financial questions that you and your family may have. Please contact us at any time.

Want more great articles on investment topics? Subscribe to our monthly Wealth Management newsletter for relevant articles about investment topics written by our advisors. Click here to sign up!