ML&R Wealth Management can help your corporate retirement plan in Austin by designing it and managing it to suit your organization’s specifications.

Our team of financial advisors in Austin work closely with you and your team to recommend ways to best manage your company’s retirement plan. We can also act as a fiduciary for companies with retirement plans which use our investment advisory services or our Third Party Administrative services.

Are you a retirement plan participant with a question? Contact us at (512) 370-3296 or retirement@mlrpc.com

Our Personal Approach To Your Retirement Plans

Are you sponsoring or considering sponsoring a corporate retirement plan in Austin? If so, you are (or will be) a fiduciary. A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties. They are legally required to act in the best interest of the other person or entity. ML&R Wealth Management can help you understand your fiduciary duty. Click here to learn more about being a fiduciary.

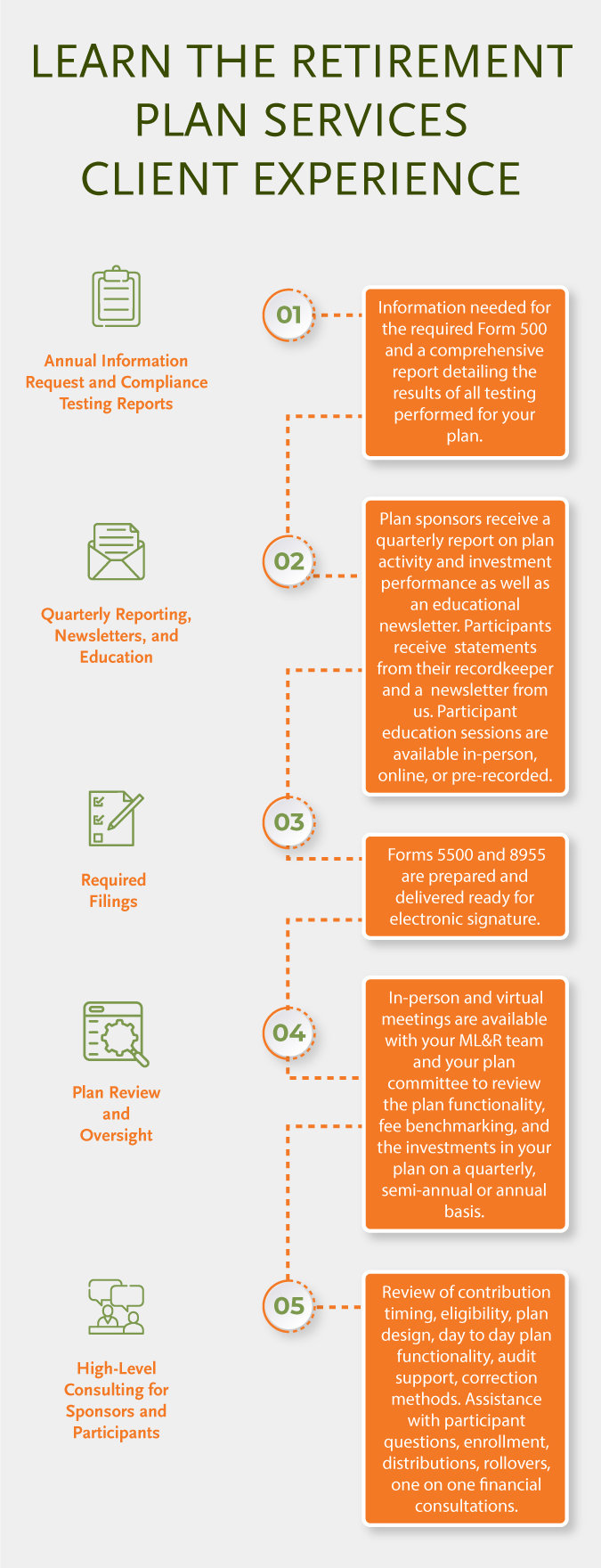

ML&R Wealth Management’s Retirement Plan Services team covers third-party administration, 3(16) plan administration, 3(21) investment advisory, 3(38) investment management, profit-sharing, pension, and cash balance plans. Our retirement planning advisors take a personal approach to corporate retirement planning and management to support the development of growing businesses.

For companies that offer a retirement or 401(k) plan, we offer the following administrative and advisory services:

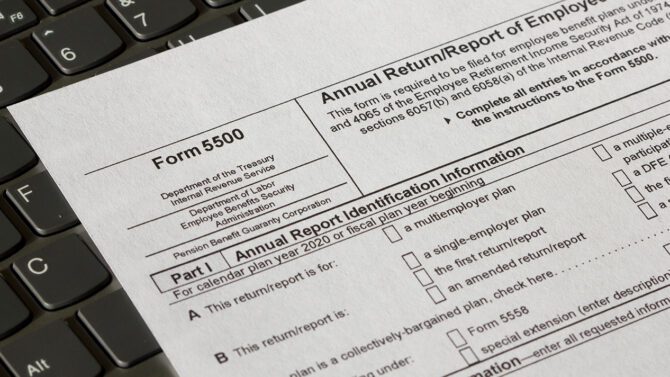

Our advisors support the creation of your company’s retirement plan documents and additional amendments. We will provide compliance testing and audit support and assist in the preparation of Form 5500.

As the plan administrator, ML&R Wealth Management takes over responsibilities and liabilities associated with review and approval of corrective refunds, Qualified Domestic Relations Orders (QDRO), signing and filing the Form 5500, loans, and all distributions.

ML&R Wealth Management provides investment advisory under a mutual agreement to serve as the primary basis for decisions based on your company’s retirement plan. Our advisors provide fund recommendations to your company’s investment committee and collaborate to determine the allocation of the funds.

As a Registered Investment Adviser (RIA), ML&R Wealth Management has the discretionary authority of the assets of the plan. Our investment managers select and monitor the funds that will be available to the participants of your company’s retirement plan.

When your company decides to move your current corporate retirement plan in Austin to ML&R Wealth Management, our Austin financial advisors take charge of the details, making the move as seamless and painless as possible for business leaders and investment committees. Feel comfortable knowing that we provide full transparency in pricing and no hidden fees.

Common Company Retirement Plans

Employer-sponsored retirement savings plans are designed with several goals in mind. Depending on the type of retirement plan, ML&R Wealth Management offers individualized administrative and advisory services.

These plans are often referred to as traditional retirement plans. Employees will receive a fixed monthly benefit at retirement and will not be responsible for making contributions to the plan.

Cash Balance Plan – A cash balance plan is a type of defined benefit plan designed to look more like the popular 401(k) plan but with the higher deductibility of a defined benefit plan. Click here to learn more about this innovative plan.

These are the most common company retirement plans today. The 401(k) is a defined contribution plan funded primarily by the employee, but often with an employer match and/or profit-sharing component. The participants choose which investments they wish to put their funds into. Click here for a list of reasons why you should adopt a 401(k).

These plans provide the benefits of a Roth IRA. Employee contributions are non-tax-deductible, however, distributions from the plan are tax-free once the employee is 59 and a half and has been in the plan for at least five years. Click here for a list of reasons why you should adopt a 401(k).

These plans are similar to 401(k) plans, but are designed for non-profit organizations, where employees are the primary funder of tax-deductible contributions.

These plans are similar to 401(k) plans with equal contribution limits. However, they are designed for state and local government employees.

SIMPLE stands for Savings Incentive Match Plan for Employees. The SIMPLE Plan is an IRA plan in which the employee makes tax-deductible contributions and an employer must match contributions of up to 3% of the employee‘s salary or make nonelective contributions.

The Simplified Employee Pension plan allows small businesses to administer a retirement plan for their employees, in which contribution limits are much more generous (25% of compensation or $56,000 for 2019).

Are you responsible for administering your company’s corporate retirement plan in Austin?

Are you responsible for administering your company’s 401k plan? If so, then check out our latest newsletters filled with up-to-date industry information below and be sure to subscribe in order to get news delivered straight to your inbox.

January 2024: Retirement Plan Services Newsletter

October 2023: Retirement Plan Services Newsletter

July 2023: Retirement Plan Services Newsletter

See our latest Retirement Plan Services articles:

ML&R Wealth Management’s advisory services for corporate retirement plans in Austin benefit both employers and employees. All parties at your company will have access to our team and be able to secure personalized, one-on-one advice from one of our qualified investment advisors. You won’t have to work through an automated 1-800 number to get questions answered—every participant of the plan can call our team directly.

For more information on our advisory, administrative, and management services for your company’s retirement plans, contact us today.

Request a consultation today

When your company decides to move your corporate retirement plan in Austin to ML&R Wealth Management, our experienced advisors help make the transition as seamless as possible. Contact our Retirement Planning Advisors to schedule a complimentary consultation. We look forward to serving you!